Table of contents

FY24 was an exciting, inspirational and action-packed time for the Corporate Team at Burch&Co. The last 12 months was marked by robust activity driven by strategic consolidations and transformative deals across our clients’ industries. Despite global economic uncertainties, we were pleased to see our clients’ resilience and adaptability, enabling them to achieve their goals.

Key Drivers

1. Australia Economic Resilience

Despite the ongoing global uncertainties that have shaped the world outlook over the past 12-months, the underlying strength of the Australian economy provided our clients with confidence and allowed them to explore various M&A opportunities. We were pleased to see that government initiatives continued to flow into the economy, which included a proactive monetary policy, funding to streamline and improve Australia’s approach to attracting foreign investment and prioritising investment into the renewable energy sector. In our view, these policies fostered an environment conducive to investment and expansion in the M&A space.

2. Technology and Digital Transformation

As we continue to roll into the cyber age, the tech sector continued to see a surge in M&A activity during the past 12-months. For our clients involved in this space, FY24 provided them with an opportunity to bolster their digital capabilities and continue to innovate rapidly. This trend is driven by the need for advanced technologies such as AI, cybersecurity and cloud solutions, and we expect this trend to continue its rapid growth in the short to medium term.

3. Ongoing investment in healthcare

We are fortunate to advise clients in the vital industry of healthcare, and we were thrilled to see these clients pull off impressive M&A deals during FY24. With investment in healthcare by the private and government sectors continuing to be significant due to an aging Australian population, we observed that deals in this space focused on: (1) scaling operations; (2) advancing medical research; and (3) enhancing service delivery. We are excited to continue advising these clients in FY25 and beyond.

4. Renewable energy push

As our society becomes more and more aware of the need to transition towards renewable energies, we have observed a positive trend in M&A activity for companies in this sector. During FY24, our clients continued to shift towards sustainable and green technologies and were able to identify various opportunities to assist them to grow in this space. We expect the evolution of this sector to provide our clients with the opportunity to be involved in exciting M&A transactions in FY25 and beyond.

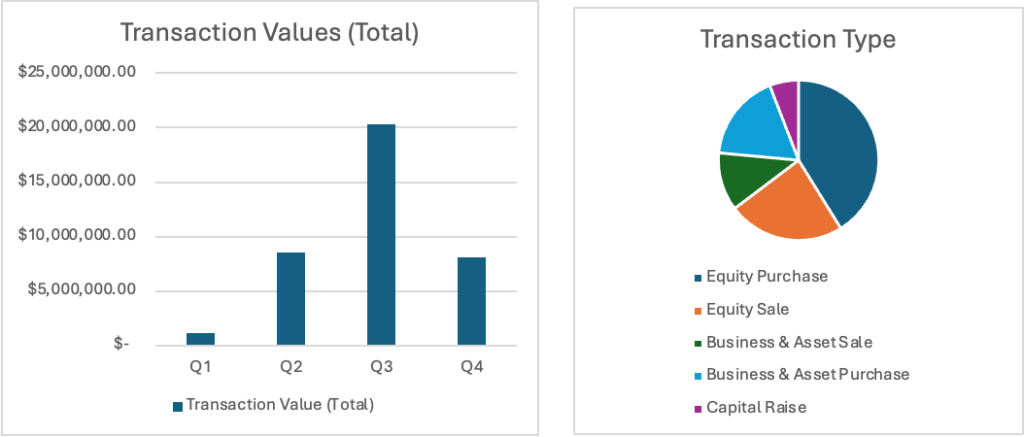

Snapshot of FY24 transactions

We are extremely fortunate at Burch&Co to work with an inspiring and stimulating client community, which spans across an impressive array of industries, including:

- Healthcare

- Hospitality;

- Software & IT;

- Retail;

- Allied Health;

- Construction;

- Real Estate & Property; and

- Energy & Utilities.

We celebrated many successes with our clients in FY24, as is illustrated by the following metrics:

| Number of transactions | 18 |

| Total transaction value | $38,110,712.33 |

| Biggest Completion Month | December 2023 |

| Most Active Industry | Healthcare |

| Smallest Transaction Size | $49,000.00 |

| Largest Transaction Size | $19,596,512.00 |

Noteworthy Transactions

Acquisition of Fertility North Holdings Pty Ltd

We were pleased to act for Monash IVF in its acquisition of Fertility North Holdings Pty Ltd, a leading fertility provider in Perth’s northern suburbs with market share in excess of 15% of the Western Australian IVF market.

The strategic acquisition expanded Monash IVF’s presence in the fast-growing Perth market and is Monash IVF’s second acquisition in the past 12 months, following its purchase of PIVET Medical Centre.

In commenting on the acquisition of Fertility North, Monash IVF’s Chief Executive Officer & Managing Director, Mr Michael Knaap said, “the transaction structure mutually aligns Monash IVF and Fertility North to grow the Fertility North business”.

We are looking forward to continuing our long-standing relationship with Monash IVF and assisting them to expand their footprint in the IVF space across Australasia.

Acquisition of Hyperspike Pty Ltd

In December 2023, Callscan Australia Pty Ltd t/as QPC Australia, the Australian arm of a global contact centre technology company, completed its acquisition of Hyperspike Pty Ltd, a boutique telecommunications provider.

The sale was a noteworthy move for both companies and enabled QPC to take a significant move forward in providing unparalleled communications and managed services to customers across Australia.

Peter Levine, Commercial Director at QPC Australia, said that the acquisition would increase QPC’s ability to deliver highly redundant and resilient business-critical voice services that its customers rely on every day.

We thoroughly enjoyed acting for QPC in this transaction and we are excited to see the company expand its global presence in the fast-paced telecommunications space.

Trends and Outlook

As Australia continues to forge ahead with its digital and sustainable transformation in FY25, we expect the following key trends to shape the M&A landscape for our client community.

1. Digital and Technological Integration

We expect there to be a continued emphasis on digital transformation across all sectors, with M&A serving as a critical tool for acquiring cutting-edge technologies and digital capabilities.

2. Sustainability and ESG Focus

Environment, Social and Governance criteria are increasingly influencing M&A decisions, and we expect that trend to continue during FY25. Companies are prioritising sustainability, leading to acquisitions that align with green initiatives and responsible business practices.

3. Regulatory Environment

The regulatory landscape will continue to evolve, with government authorities ensuring that M&A activities promote healthy competition and do not lead to market monopolies. Companies will need to navigate these regulations carefully to execute successful deals.

Conclusion

FY24 has underscored the enthusiasm and strategic importance of the M&A market in Australia. Businesses are leveraging mergers and acquisitions not just to survive but to thrive, driving innovation, growth, and sustainability. As we move forward, the M&A market is poised for further evolution, shaped by technological advancement, stabilising economic conditions, and improved regulatory frameworks. Companies that can proficiently navigate this landscape will be well-positioned to capitalise on the opportunities it presents.

Whether you are seeking to expand, innovate, or streamline operations, the current market conditions offer a fertile ground for strategic growth. For businesses looking to explore M&A opportunities, please get in contact with us at Burch&Co. We would be thrilled to help you navigate this dynamic market and unlock the full potential of your business.