Table of contents

Part 2 of the Startup Playbook Series

In part 2 of the Startup Playbook Series, we look at the best operating structures for most startups.

Pty Ltd you say?

By the time you are ready to engage with the world, it is important that your startup has its own registered corporate identity – a registered company. (See our series instalments on: Employees & Contractors, Clients & Customers, and Suppliers to learn more about getting ready to engage with the world.)

Registering as a company is important for a number of reasons – limitation of liability, ownership of assets, operating as an independent legal entity, and taxation treatment, to mention a few. The most common set up these days is a proprietary limited company, in which you hold shares.

What’s wrong with being a sole trader?

If you were to operate as a sole trader (where you conduct your business in your name, with an Australian Business Number or ABN) there are a number of disadvantages:

- Your liability is unlimited

- You will be charged tax in accordance with the marginal tax rate for individuals – rather than at a corporate rate (this may or may not be in your favour, depending on your individual tax rate)

- You will not be able to issue shares in your business to co-founders, investors or employees

- You cannot access Research & Development (R&D) Tax incentives.

These are just some of the reasons why a company structure is preferred by traditional businesses and startups, alike. However, there are two main corporate structures which startups utilise.

1. Single Proprietary Limited Company Structure

A single company structure is one where all of your business activity and all of your assets and intellectual property sit within the one company. If you are a sole founder, you will often be the sole director, secretary and shareholder of the company.

This structure is often a good place to start, as it is the simplest corporate structure – providing all the upsides of incorporating as a company, without any of the expense of setting up, and running a more complicated structure.

2. Holding Company & Operating Company Structure

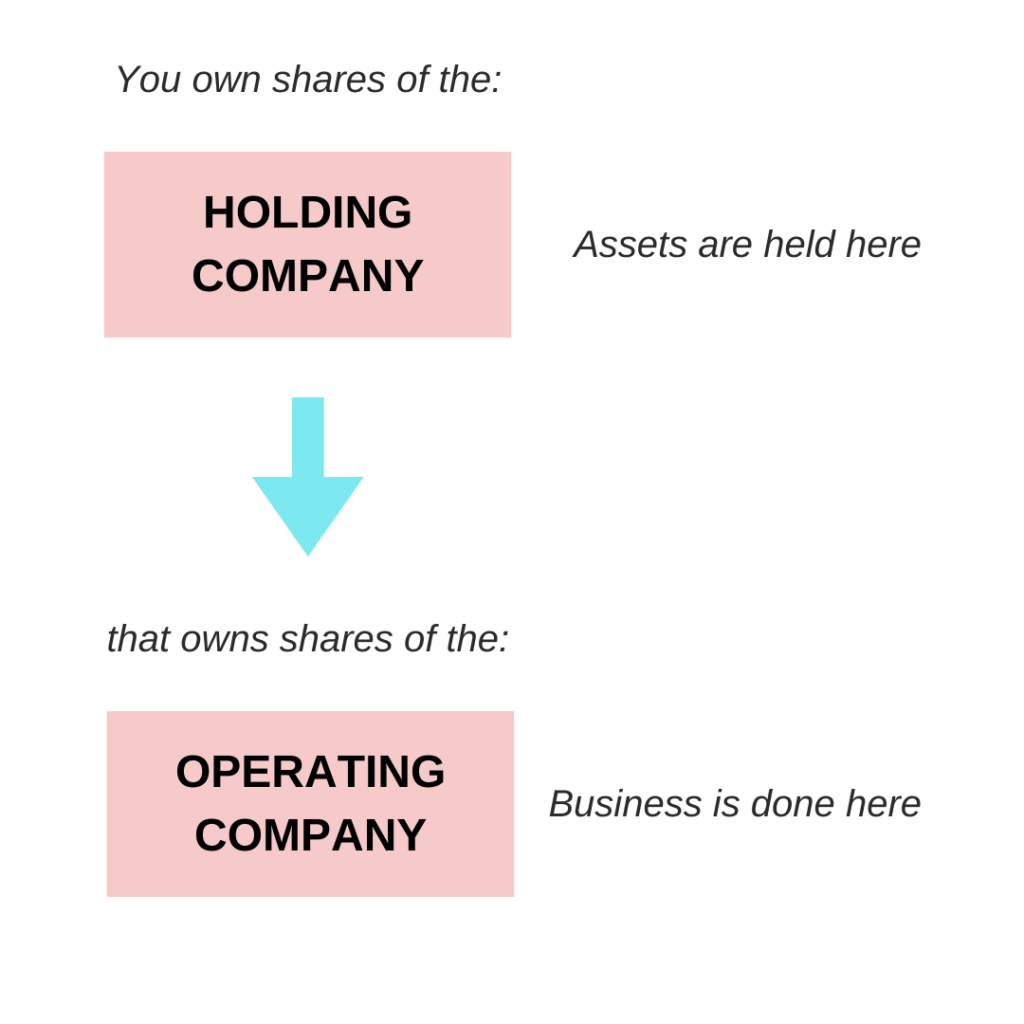

A holding company and operating company structure is one where you have two companies instead of one. Company One (the holding company) holds the assets and Intellectual Property of your business. This is the company which you and your co-founders ‘own’ or hold shares in. It is the holding company which holds all the shares of Company Two.

Company Two (the operating company) which is owned by Company One, is the company which engages in business – enters into contracts, takes on risk, and goes out and says hello to the world. This includes everything from contracts with Employees & Contractors, Customers & Clients, or Suppliers.

The reason you may wish to go to the effort and expense of utilising this structure is the extra layer of legal protection it affords. Expansion into other revenue streams, through multiple operating companies, is also a strategy that growing businesses pursue. Often the most valuable asset in a startup is the intellectual property you have created (as well as any funds you may have raised). This structure enables this value to sit in a corporate entity separate to the one taking on the commercial risk. If you were to be sued, it would be Company Two which would be sued – and not the holding company.

The value of advisors

Your accountant and tax advisors can be really helpful sources of information when it comes to your organisational structure and set up, as there are many tax considerations that could come into play when you scale. Ensuring your set up is done correctly from the get-go is important to make sure that you have set yourself up for success, and seeking advice from accountants that are familiar with the startup ecosystem will take you a long way at the start of your journey.

In contrast, when startups start their operations under an ill-fitting organisational structure, it can be costly, time consuming and nerve wracking to un-do. Some structures that work fine for small businesses may be wholly inappropriate for startups. For example, a discretionary trading trust could be a perfect solution for a mom’n’pop shop, but a startup may be prevented from applying for grants or seeking investment under such a structure.

What role does the accountant play?

As lawyers, we see ourselves as playing an important role in the life of your business. But we are not the only support act – your accountant will also be an indispensable part of your business operation. Although many people try to go it themselves using accounting software (like Xero, Quickbooks or MYOB) building and maintaining a relationship with a good startup accountant is often the difference between well-maintained books and a chaotic financial mess of record keeping. (For the importance of keeping good financial records, see the instalment on early stage investment.)

Accountants provide a range of business services, including:

- Setting up the company

- Acting as your ASIC agent

- Bookkeeping services

- Payroll (including leave and superannuation)

- Tax returns

- BAS/GST

- Issuing shares

- Managing your share register

- Assisting with cap table management

- ASIC reporting

Read on to Part 3.1 Shareholders Agreements.

We are fortunate to work with a number of accountants who are experienced in helping startups with their organisational structure and set-up. Get in touch with the Burch&Co Startup & Capital team if you would like us to introduce you to experienced startup accountants.